ITAT Full Form, Tribunal Orders and Cause List Explained

Learn the ITAT full form, its meaning, and the role of the Income Tax Appellate Tribunal in resolving tax disputes. Explore how to check ITAT tribunal orders, daily cause lists, and recent judgments online. Stay informed about ITAT updates, case status, and important decisions affecting taxpayers and professionals.

https://www.registrationkraft.com/itat-full-form

#ITAT #IncomeTaxAppellateTribunal #TaxUpdates #TribunalOrders #CauseList #TaxDisputes #IncomeTaxIndia #ITATOrders #TaxJudgments #TaxLaw #TaxProfessionals

JustStart offers an online GST registration service designed to simplify the process for businesses and individuals in India. The service provides expert assistance in obtaining a unique GSTIN, enabling taxpayers to collect and remit taxes on their products or services. Key features include professional guidance throughout the registration process, the ability to view and track application status, and a commitment to completing the registration within three business days. The service is priced at ₹1,999, inclusive of all taxes. https://juststart.co.in/service/gst-registration

What is the GST Amnesty Scheme? Simplified Guide for Taxpayers

Discover the GST Amnesty Scheme, its benefits, and how it helps taxpayers resolve compliance issues. Learn about eligibility, deadlines, and key provisions to stay tax-compliant.

https://www.registrationwala.com/knowledge-base/gst/gst-registration/what-is-the-gst-amnesty-scheme

#𝗞𝗻𝗼𝘄𝗹𝗲𝗱𝗴𝗲_𝗕𝗮𝘀𝗲: GSTR 3B is a return form which must be filed by the taxpayers on a regular basis. It reflects details of sales, ITC claims, tax liability, refunds, etc. To find out what is GSTR 3B, GSTR 3B return due date, late fee and return filing process, read this blog post.

Know more: https://www.registrationwala.com/knowledge-base/gst/gst-registration/gstr-3b-due-date-late-fee-return-filing

::

#GSTR3B #GSTR3BReturn #GSTFiling #TaxReturn #ITCClaims #TaxCompliance #ReturnFilingProcess #TaxDueDate #GSTR3BDueDate #GSTForms #GSTRegime

GSTR 3B: Due Date, Late Fee & Re..

Understand everything about GSTR 3B, including due dates, applicable late fees, and step-by-step instructions for filing your GST returns on time.

https://www.registrationwala.com/knowledge-base/gst/gst-registration/gstr-3b-due-date-late-fee-return-filing

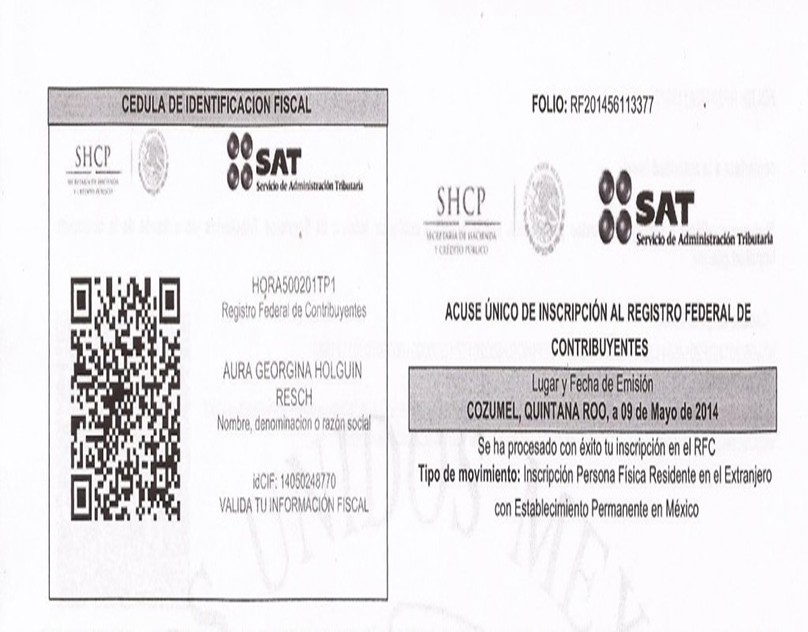

A Comprehensive Guide to the RFC for Individuals and Businesses in Mexico

https://rfccalcular.mx/

The Registro Federal de Contribuyentes (RFC) is a crucial component for anyone wishing to operate legally in Mexico. This guide offers essential information about the RFC, including its significance, the application process, and the advantages it provides to individuals and businesses.

What is the RFC?

The RFC, or Federal Taxpayers Registry, is a unique identification number assigned to both individuals and entities engaged in economic activities in Mexico. This identification is vital for t

GSTR 3B: Due Date, Late Fee, and Filing Guide

GSTR 3B is a return form which must be filed by the taxpayers on a regular basis. It reflects details of sales, ITC claims, tax liability, refunds, etc. To find out what is GSTR 3B, GSTR 3B return due date, late fee and return filing process, read this knowledgebase post.

https://www.registrationwala.com/knowledge-base/gst/gst-registration/gstr-3b-due-date-late-fee-return-filing

Filing ITR in a timely manner is crucial for the taxpayers in India. Failure to file ITR on time can attract penalties and interest charges, which can be heavy on the pocket. In addition to this, in some cases, filing the ITR in a late manner may lead to the suspension or termination of your employment by your employer.

💠Let’s Explore the Impact of Missing ITR Filing Deadline

Visit now👉 https://www.registrationkraft.com/what-happens-if-you-miss-the-itr-filing-deadline/

#itr #itrfiling #itrfilingseason #itrdeadline #incometax #incometaxreturnfile #taxpayers #incometaxact

What happens if you miss the ITR..

Filing ITR in a timely manner is crucial for the taxpayers in India. Failure to file ITR on time can attract penalties and interest charges, which can be heavy ..

https://www.registrationkraft.com/what-happens-if-you-miss-the-itr-filing-deadline/